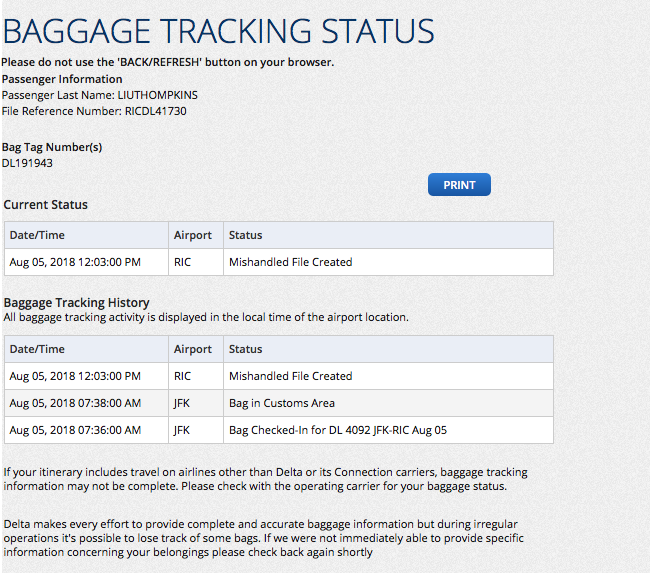

Last week I wrote about my unfortunate service incident with Delta Airlines that made me question my loyalty to the company. That got me digging a little deeper into how vulnerable customer loyalty really is. The statistics I found revealed some solid quantitative evidence of how vulnerable customer loyalty can be. I want to share with you some of the numbers that I discovered.

Loyalty is Not What It Used to Be

An Accenture survey of 25,426 consumers in 33 countries reveals that 77% of consumers admitted to retracting their loyalty more quickly now than they did three years ago. More importantly, loyal customers who spent more with a brand switched to another brand or provider 17% more often in the previous year than those who spent less. These loyal consumers were also 9% more likely to retract their loyalty altogether. Similar findings have come from an earlier study reported in Harvard Business Review, where best banking customers may be the first to defect when a new option becomes available.

Not only have loyal customers become more fickle, but many consumers are not inclined to be loyal in the first place. The Accenture survey shows that 36% of consumers consider loyalty to be irrelevant to their spending. In a separate survey of 7000+ consumers by Corporate Executive Board, only 23% of consumers were interested in having a relationship with brands. A study by McKinsey further shows that many retailers’ best customers are indeed just heavy users that spend a lot at competitors too. For a large DIY chain, 45% of lost revenues to competitors were through the chain’s best customers. Continue reading “Vulnerability of Loyalty in Numbers”