I’ve always liked Delta Airlines. In my perception (perception is reality, right?), Delta has nice airplanes, friendly staff, and generally good service all the way around. I consider myself a loyal customer of Delta. With the exception of mandated price shopping for work travels, I always like to look at Delta first when I need to go somewhere. But my recent service issue with Delta caught me completely by surprise. It made me question if I had misplaced my loyalty this whole time.

The Delta Luggage Incident

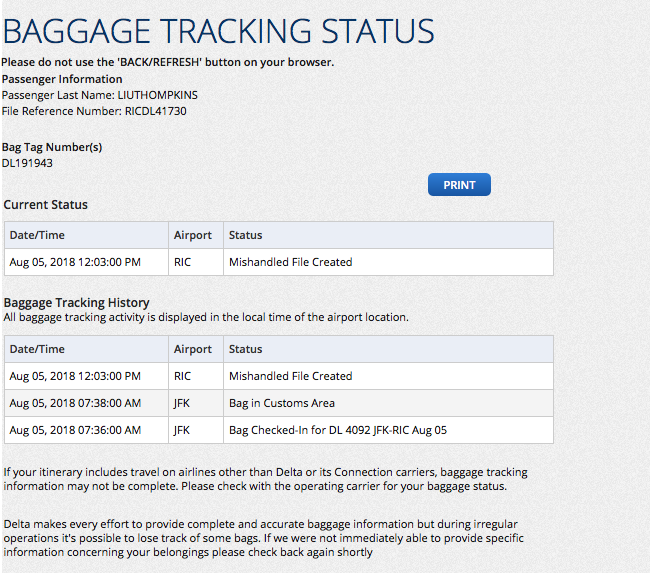

It was something simple really. While coming back from my international travel, I rechecked my luggages at the New York JFK airport for the last domestic leg of my long flight home. When I reached the destination, two of my three checked-in luggages showed up on the conveyer belt, and the third one did not. I filed a claim with the Delta baggage service right away and was informed that Delta would contact me for delivering my luggage. In the days that ensued, I checked the online status of the luggage regularly. Unfortunately it never changed.

After 10 days not seeing any change and not hearing anything from Delta, I finally picked up the phone to call Delta. Having to hold for half an hour on the phone and still no one on the line, I reached out to Delta via Twitter instead. Luckily that got me a faster response than the good ol’ phone. In a few minutes of messaging with the Twitter service rep, I was informed that the status means that my luggage was in the security area. The rep asked what the luggage looked like and what was in it. I told him/her that it was a smart balance scooter (like the one you see at the top of this page). This was when I was informed of a Delta policy that I had been complete unaware of previously. The screenshot of the stated policy is shown below. Continue reading “An Ambush on Customer Loyalty”