Established about about nine years ago, ING Direct (the US subsidiary of the Netherlands-originated ING Group) has quickly become a popular bank among tech-savvy and savings-oriented customers. Much of its success can be contributed to the way it engages and empowers consumers, as described in the book The Orange Code coauthored by ING Direct’s founder & CEO Arkadi Kuhlmann and the branding expert Bruce Philip.

Start with the Brand

As a brand, ING Direct stands out with its distinctive orange dot logo, like the way Apple stands out with its half-eaten apple logo. The color came from its parent company ING Group’s logo — an orange lion. Considered the most “edible” color, the warm tone of orange conveys a sense of energy and caring. The dot further adds the touch of fun and rebellion. Together, the orange dot is a significant departure from the usual uptight image of suit and a tie associated with most banks. This is perfect for ING Direct’s target audience of younger and tech-savvy consumers.

Social Media Engagement

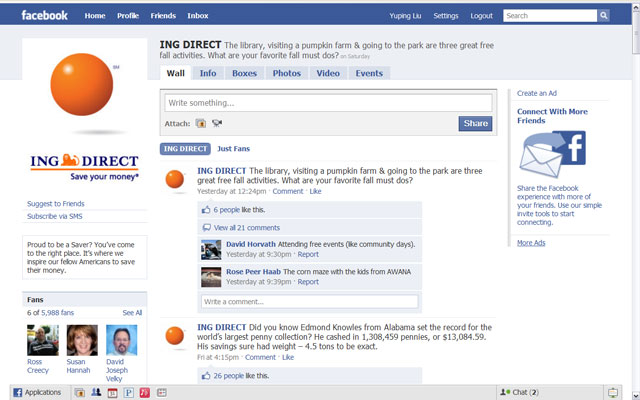

ING Direct’s social media portfolio consists of a fairly standard set of tools: Facebook page, Twitter, Flicker, YouTube, and a blog called “We, the Savers“. While any company can establish a presence on these social networking sites, not everyone is able to build them into interactive channels that truly engage the customer. I am especially impressed with ING Direct’s Facebook page (see the screenshot above). Here are a few things that I think they are doing particularly well:

1. A clear mission: consumers. Instead of trying to sell their financial products, the page has a clear mission: to serve “We, the Saver”. As the little blurb in the left side bar puts it concisely: “Proud to be a Saver? You’ve come to the right place. It’s where we inspire our fellow Americans to save their money.” This goal of “inspiring” rather than “selling” brings consumers much closer to the company, uniting the savers into one big family. In today’s economic environment, this likely resonates with a lot of consumers.

2. Content from third-party sources that has nothing directly to do with the bank but very relevant to consumers. For example, a recent post on the page is an article from the website getrichslowly.org on how to use a flowchart to evaluate potential purchases. This is information that savers would really be interested in reading. ING Direct then adds a little personal touch to the content by adding in the comment: “We learned about flow charts in 7th grade English class. This is the first practical use we’ve seen since then:” This again reflects a consumer-centered approach and comes cross to consumers neither as pushy nor condescending as one might expect from a commercial bank.

3. Plenty of opportunities for interaction. Oftentimes ING Direct posts little fun questions to consumers on the page (and via Twitter). Here are a few questions asked recently: (1) “The library, visiting a pumpkin farm & going to the park are three great free fall activities. What are your favorite fall must dos?” (2) “Our favorite “money” movie quote may be from Swingers- ‘You’re so money and you don’t even know it!’ What’s yours?” (3) “Simple tips from everyday people on how to save money on everyday expenses: Got any others?” (4) “Will your next car be new, or pre-owned?” These questions are things that consumers can easily relate to and answer, which motivate them to participate in the conversation. I always see at least a dozen responses and comments on such posts, which also translates into potential better understanding of consumers by the company.

Take Away for Marketing Practitioners

Social media give power to people, and to win in this arena, focusing on the people is a must. Traditional mindset of selling is not going to work in this setting. If your business does not have the courage and culture to adapt to this new collaborative environment, it may be worse to pretend to be a social media participant when nothing you do is “social”. The end results will be skeptical consumers and wasted resources. ING Direct’s social media strategy offers good ideas on how to do this properly. For those who want further guidance, I recommend this Smashing Magazine article: “Social Network Design: Examples and Best Practices“. You may also find this report on the top 100 brands’ customer engagement level and its business impact useful.

Take Away for Marketing Academics

While customer relationship management and relationship marketing have gained strong hold in the academic marketing discipline, I think there has not been enough attention paid to customer engagement, especially through the use of social media. I suggest a few research questions below that I believe are relevant to both marketing theory and practice.

- How do we properly gauge customer engagement? Is this a state of mind? Or is this measured by the number of conversations and/or followers?

- How should models of persuasion in traditional advertising being modified in the context of customer engagement?

- Do consumers undergo different processes to form their attitude and satisfaction judgment when they are engaged with the brand vs. when they are not?

- What metrics should be used to measure the outcome/ROI of customer engagement?

- With these metrics in place, can we show that customer engagement does lead to visible business benefits?

What are your thoughts about customer engagement? I’d love to hear your stories and questions about customer engagement.

One thought on “Best Practices — Engaging Customers at ING Direct”

Comments are closed.